Empty dropdown

Notes:Data is as of 30 September 2024. Location is based on where company is incorporated.

17 min read

The European tech ecosystem has been transformed over the past decade - from talent, to capital, to company building and value creation. Yet we've seen a lot of dispiriting headlines this year. It’s been a year of political and regulatory turmoil, people are concerned about the challenges identified in Mario Draghi’s report and there’s scepticism about Europe’s ability to support breakthrough companies as they grow. It's a paradox that requires some scrutiny and our annual report aims is to bring some perspective because perspective has never been so important. With this special 10th anniversary edition, we are looking not just to 2024, but to the past decade and what lies ahead.

Share

To be successful, an ecosystem relies on three key pillars: talent, capital, and ambition. The last one is more difficult to quantify, but $B+ companies are an expression of the ambition of founders to build tech champions at local, regional and global levels as their companies scale in size and impact.

Since 2015, all three pillars have been transformed across many countries across the continent. Once rare, $B+ companies are now a feature of almost every European economy. In fact, 11 ecosystems that were yet to produce a $B+ success story by the end of 2015 now boast one or more.

While gains have been made across the board, the biggest leaps forward have taken place in the UK, Germany and France. These countries have gone from accumulating low double-digit or even single-digit funding levels in the decade leading up to 2014 to attracting a combined $250B over the past 10 years — the UK even nears the $150B mark. The tech headcount in these countries has also grown by 6-8 times (in line with the wider 7 times increase seen across Europe), with the total count of employees hired by UK-based tech companies approaching a notable 1M employees. Across European countries, an average of 72% of tech employees work in the same country as their company’s headquarters; the rest are based elsewhere in the region, contributing to the growth of other ecosystems through job creation and knowledge transfer.

The growth trajectory of these countries illustrates the power of the flywheel effect: Europe’s first $B+ companies came from the UK, Germany, France and Sweden, paving the way for more funding, talent and billion-dollar companies to thrive.

The fact that we have more than 300 unicorns in Europe is amazing. And the fact that a lot of these unicorns are profitable, fast growing iconic companies like Wise, Spotify, and Adyen. Nobody would have believed this in the early 2000s. If we think about it, Europe has a maybe 30 year lag to Silicon Valley. We can only think about where we're going to be in 10 years, 20 years from now; a lot more companies will get to the same state. We have all the ingredients for the trillion dollar companies to be born in Europe."

Taavet Hinrikus

Co-Founder, Wise, Founding Partner, Plural

Europe’s talent landscape has transformed over the past decade, and the startup ecosystem now attracts more employees than ever. Today, the European tech workforce stands at 3.5M. The vast majority of those employees have joined over the past decade with close to 3 million jobs created over that time frame. It's growing at a 24% compounded annual growth rate, which puts Europe on par with the US’s more established scene.

These figures are even more impressive in the context of the last two years, when headlines about funding shortages and staff redundancies have been hard to miss. Against the odds, Europe's tech sector has remained attractive to new talent and its importance as a contributor to the continent's workforce continues to grow.

Taking a 20-year horizon illustrates how much the ecosystem has grown. Our pool of capital invested in companies has in fact increased 10 times in ten years, enabling this talent to thrive.

In Europe, the total funding over the past 10 years is 10 times higher than that of the previous decade, having grown from $43B to $426B. To put this in perspective, 2024 is on track to see $45bn capital invested, so in one year it will exceed the amount invested in a whole decade. By comparison, the US grew 2.8 times over the same period, from $249B to $1.2T.

Investment into European tech has levelled up significantly over the past decade. This year, investment levels are on track to reach around $45B — three times as much as the $15B recorded in 2015.

The VC-backed ecosystem is currently in the process of stabilising after two outlier years. Investment levels peaked at an unprecedented $101B in 2021 — up 170% year-on-year. As the broader macro environment shifted, capital invested has since reverted back to levels in line with the long-term growth trajectory of the ecosystem. While this year’s projection is slightly lower than 2023’s $47B, it’s likely to align more closely with the coming quarters as more investments are announced retrospectively.

It is also 20% higher than the level of investment seen in 2020, suggesting the market as a whole has reached a new equilibrium, despite a few turbulent years.

There is a greater public understanding of entrepreneurship, the attractiveness of the start-up career path, and more ambition.

Most experienced founders say public perception of entrepreneurship has improved, and that shows in the number of people pursuing careers in the sector. The most ambitious founders starting out today don't dream of building a billion-dollar company. They aspire to grow to 100 times that scale.

Niklas Zennström, Co-Founder, Skype, Founder & CEO, Atomico

From “building a multi-billion dollar revenue business” to “life on Mars”, European founders continue to shoot for the stars. Notably, beyond the goals of revenue targets, market leadership and big exits, many founders cite making a positive impact as their ultimate goal.

For 41% of respondents, their ambition is not to build a business, but "leave a legacy with a significant environmental and financial contribution". Some respondents told us they will achieve success when their brand is "ubiquitous". What struck us as we read through the most ambitious statements from the thousands of responses was the clear alignment of success with positive outcomes for the planet — for example, one respondent mentioned "permanently removing 1 gigatonne of CO2 per year, profitably", while another is looking to "build a generational business that can reduce electricity costs by 95%".

The ability to impact society is also evident in some of the metrics communicated by founders, such as "1 billion happy users and 1,000 happy employees", or having "the largest market capitalisation in Europe".

And with this change in mindset, we’re seeing more companies, more ambitious ideas, built to solve harder problems. Founders are upping their game.

Travelling back to 2015, there were just shy of 8,000 early stage companies. Fast forward to 2024, and that number has more than quadrupled to 35,000+. Growth-stage companies have seen an eightfold increase to over 3,400 and there are more $B+ valued companies in Europe than ever before. These numbers give us the best bird’s-eye view perspective of truly how much stronger Europe's entrepreneurial muscle has become in a decade. It’s exciting to think where the next decade might take us.

Over that time frame, Europe has generated world-class returns and a growing track record of exits. It has scaled valuable firms across sectors and the breadth of the continent.

In fact, Europe has witnessed billion-dollar companies emerge across 30 unique countries, reflecting the continent’s broad entrepreneurial reach. As these companies grow and advance along their funding journey, many will eventually reach the point of an IPO or acquisition. However, exits tend to lag behind both $B+ valuation milestones and especially company formation, so it's perhaps unsurprising that, to date, only 15 European countries have seen a billion-dollar exit. This trend underscores the time it can take for these high-value businesses to reach liquidity events, even as they continue to expand and scale.

This cluster of countries is centered on Western Europe, stretching as far east as Poland and as far south as Italy. But even among this cluster, exits aren’t evenly distributed. Almost half of all $B+ exits over the past decade took place in the UK alone, including the two biggest exits Europe has seen since 2015: IHS Markit’s $45B acquisition in 2020, and ARM’s blockbuster IPO in 2023, which closed its first day of trading with a market cap of $65B.

Sweden comes next, having been host to Europe’s third-biggest exit when Spotify went public via a direct listing in 2018. Germany follows, with Berlin-based AUTO1 being the the seventh largest exit in Europe over the past decade, followed by Delivery Hero's 2017 IPO. Poland also follows, home to top 10 exited company Allegro.

$925B

Europe’s biggest success stories of the past decade? Spotify and Revolut.

That’s according to our survey respondents, who were asked to name the company they thought was emblematic of Europe’s growth over the past 10 years. This was an optional question and no prompts were provided — impressively, Spotify and Revolut were named by 26% and 15% of respondents, respectively. But what's more is that more than 110 unique companies were named by respondents more than once, and close to 30 mentioned over 10 times.

Describing these companies as European champions hardly captures their impact. Some of these globally recognised brands have inspired both founders and investors, and are part of the draw for many new joiners coming from outside of tech. Spotify has transformed the music streaming landscape and created a ripple effect in the wider market for digitally distributed audio content.

Finance companies — Revolut, Klarna and Adyen — grab the next top spots, underlining Europe's characterisation as a global centre of excellence for finance. Finally, the presence of Mistral, which was only founded in 2023, in a list of the most influential companies of the past decade highlights Europe's ambitions to create its own AI leaders.

HQ: Sweden

580+ mentions

HQ: United Kingdom

350+ mentions

HQ: Sweden

110+ mentions

HQ: Netherlands

90+ mentions

HQ: France

90+ mentions

HQ: Netherlands

85+ mentions

HQ: Finland

60+ mentions

HQ: Estonia

60+ mentions

HQ: Romania / United States

50+ mentions

HQ: Germany

50+ mentions

HQ: United Kingdom / Estonia

50+ mentions

HQ: United Kingdom

45+ mentions

Over the past decade, M&A and IPO transaction values in Europe have steadily increased, consistently surpassing $50B per year threshold, aside for 2024YTD. While some level of activity has persisted over the past two years, transaction volumes across both M&A and IPOs are at their lowest point in the past decade as liquidity routes remain subdued post correction.

A handful of blockbuster transactions are driving the overall transaction value. In 2023, ARM’s $65B IPO alone accounted for 92% of the total IPO value, while in 2020, the $45B IHS M&A deal represented 35% of that year’s total M&A activity.

Europe has come a long way over the past decade, but there is more work to be done if the continent’s tech ecosystem is to reach its full potential. We asked our survey respondents what they think the key priorities for the next decade should be to unlock Europe's growth.

We have more new founders starting companies in Europe than in the US today, yet questions are starting to be asked about Europe’s attractiveness as a place to start and scale a tech company - especially by our most ambitious talent. We asked thousands of industry participants about what could stand in the way of Europe’s potential. From founders to talent to investors, there are frustrations about the continued challenges faced when it comes to regulation, bureaucracy, capital, and scaling across a still fragmented European market. In fact 47% of overall respondents see regulation and policymaking as a barrier to Europe to fulfilling its full potential — that’s almost one in two respondents. There are fears that these challenges could erode the future success the ecosystem has set itself up for.

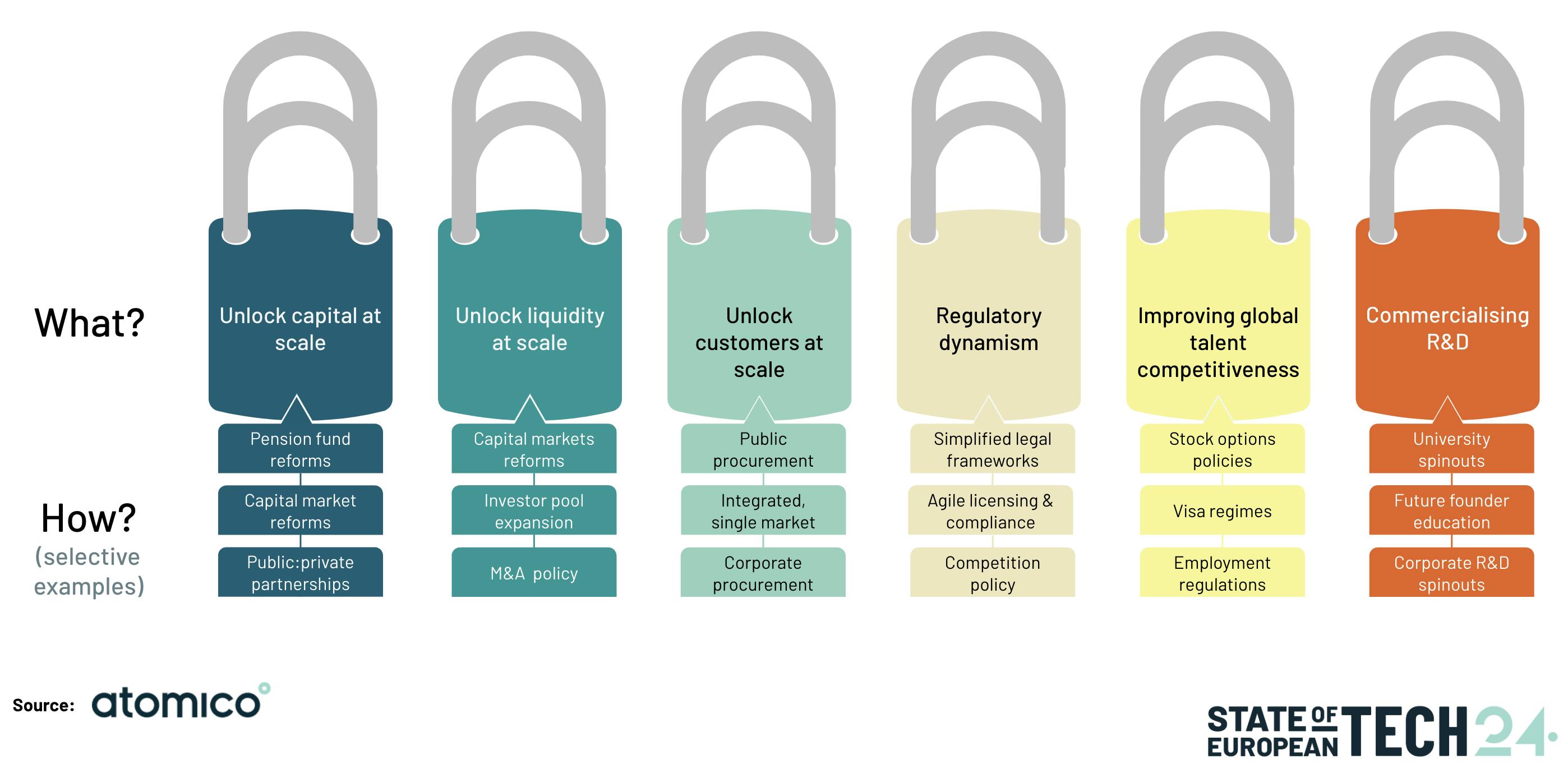

We’ve organised the barriers to success under six keys to unlock the future European tech deserves. These span from unlocking capital at scale, to liquidity, to customers, to regulatory dynamism, global talent competitiveness and commercialising R&D.

None of these individually is insurmountable, but bold, positive action is needed. We must support those who are finding new ways to tackle old problems. An example is the ‘28th Regime’ or EU Inc, as it’s sensibly been rebranded, an EU legal framework that would allow businesses to operate in a single market. This would scale back bureaucracy and scale up ease of doing business across European borders.

One issue which consistently hampers Europe’s scale up ambitions is the growth funding gap. Since 2015, the lower conversion rates to growth stage rounds meant that $300B worth of potential funding was never raised in Europe. In addition, in the Investors chapter we explore that European investors are having to rely on US investors to bridge a further $75B. This brings the total European growth stage funding gap to $375B.

$375B

Investment from pension funds and major insurers provides the beginnings of the solution. If we take a look at European pension funds, they currently invest just 0.01% of capital into european venture - a rounding error for the $9 trillion of assets they are managing. Despite a robust local startup ecosystem, pension funds in the UK and Ireland allocate just 0.007% of AUM to VC. Across the continent movements are being made to address the issue from the UK’s Mansion House reforms to the French Tibi initiative. Doing so could result in billions more capital available to Europe’s scale ups. This could be the difference between the best and brightest companies scaling from Europe and being forced to relocate to Silicon Valley.

Mindset is a key pillar of the success of our ecosystem, and more than any of the challenges identified in our survey, it is a risk to unlocking Europe's success. If we rise to the challenge, we can look forward to another transformative decade. A mantra for the team working on this report is that it's human nature to overestimate what's possible in the short term, but underestimate the long term.

In ten years' time, the talent pool will have become even stronger and will continue to attract new joiners at a similar rate to the last decade. This means an additional 15 million jobs created by Europe's technology companies.

Capital will be unlocked for scale - allowing Europe to keep its brightest minds here, focused on solving our society's and economy's toughest problems.

European tech will make a significant contribution to the continent's GDP by adding $5T worth of ecosystem value - growing at a compound annual growth rate of 10%, in line with more mature ecosystems such as the US. This would bring Europe's total ecosystem value to just over $8T. And by then, Europe will be home to its first trillion-dollar company.

If we can keep up the momentum and address the challenges we’ve set out, Europe will be a tech superpower that’s fit for a new generation. It will be highly dynamic and conscious of the impact it's having on the world and a home to the world's most ambitious companies.

A technology superpower for a new generation.

"I’m incredibly proud of so much of our vision becoming reality. This is in terms of how strong the ecosystem is, but much more importantly, how many people have been participants in building it to have GDP level impact. Progress was very hard and very slow at the beginning, but we can see it happening so much faster now.

Reshma Sohoni

Founder, Seedcamp

How are Europe’s companies tracking when it comes to investment? This chapter explores the flow of capital into the continent’s startups, from how companies are performing at different stages and in different regions, to which founders are most likely to achieve $1B+ outcomes.

European tech companies attract more funding than ever, yet the continent still has some way to catch up to the US. The European funding gap is a critical challenge, and the potential rewards in closing it are immense, from enabling more founders to build $B companies to retaining top talent and capturing more value within Europe.

The pace of AI-driven innovation is only accelerating, and in 2024 Europe has continued to bolster its position as a global leader in this theme, although there is still room to grow. This fast-track insight tells the story of how AI came to be the theme on everyone’s mind in Europe and beyond over the past decade.